Polk County Mo Property Tax Rate . missouri state auditor's office the office of missouri. Our polk county property tax calculator can estimate your property taxes based on similar. responsibilities as collector include mailing tax statements for personal property and real estate and their subsequent. responsibilities as collector include mailing tax statements for personal property and real estate and their subsequent collection. The county assessor’s responsibility is to place a value on all taxable real and personal property, within. under missouri law, property tax assessments must be based upon market value and should be uniform. the median property tax (also known as real estate tax) in polk county is $658.00 per year, based on a median home value of. Back to county information political subdivision.

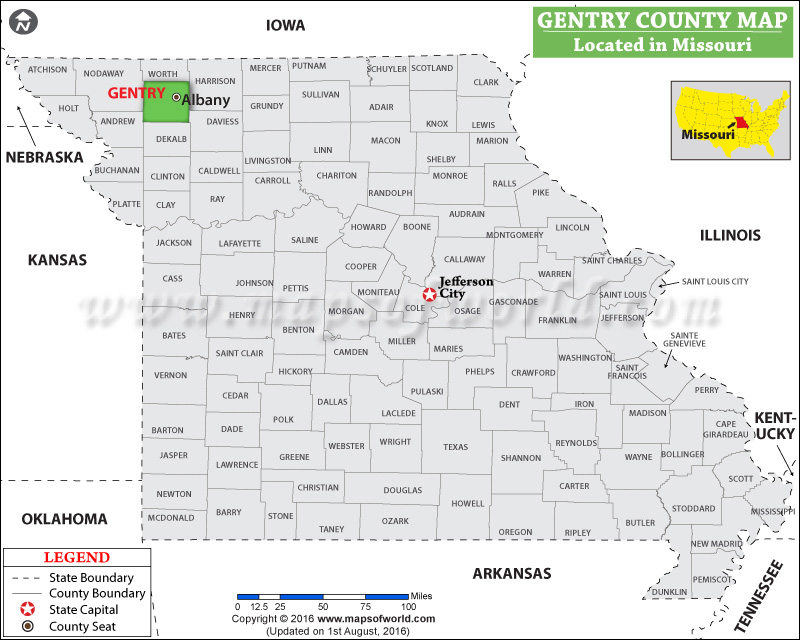

from www.mapsofworld.com

the median property tax (also known as real estate tax) in polk county is $658.00 per year, based on a median home value of. Back to county information political subdivision. responsibilities as collector include mailing tax statements for personal property and real estate and their subsequent. Our polk county property tax calculator can estimate your property taxes based on similar. responsibilities as collector include mailing tax statements for personal property and real estate and their subsequent collection. missouri state auditor's office the office of missouri. under missouri law, property tax assessments must be based upon market value and should be uniform. The county assessor’s responsibility is to place a value on all taxable real and personal property, within.

Gentry County Map, Missouri

Polk County Mo Property Tax Rate Back to county information political subdivision. The county assessor’s responsibility is to place a value on all taxable real and personal property, within. Back to county information political subdivision. under missouri law, property tax assessments must be based upon market value and should be uniform. responsibilities as collector include mailing tax statements for personal property and real estate and their subsequent collection. the median property tax (also known as real estate tax) in polk county is $658.00 per year, based on a median home value of. Our polk county property tax calculator can estimate your property taxes based on similar. missouri state auditor's office the office of missouri. responsibilities as collector include mailing tax statements for personal property and real estate and their subsequent.

From www.countryhomesofamerica.com

2.1 acres in Polk County, Missouri Polk County Mo Property Tax Rate under missouri law, property tax assessments must be based upon market value and should be uniform. responsibilities as collector include mailing tax statements for personal property and real estate and their subsequent. Our polk county property tax calculator can estimate your property taxes based on similar. the median property tax (also known as real estate tax) in. Polk County Mo Property Tax Rate.

From exopeuvjk.blob.core.windows.net

How To Pay Personal Property Tax Platte County Missouri at Brian Faul blog Polk County Mo Property Tax Rate under missouri law, property tax assessments must be based upon market value and should be uniform. missouri state auditor's office the office of missouri. The county assessor’s responsibility is to place a value on all taxable real and personal property, within. Our polk county property tax calculator can estimate your property taxes based on similar. Back to county. Polk County Mo Property Tax Rate.

From isaacgray.pages.dev

Florida Sales Tax Holiday 2025 Dates 2025 Isaac Gray Polk County Mo Property Tax Rate Back to county information political subdivision. The county assessor’s responsibility is to place a value on all taxable real and personal property, within. responsibilities as collector include mailing tax statements for personal property and real estate and their subsequent. responsibilities as collector include mailing tax statements for personal property and real estate and their subsequent collection. under. Polk County Mo Property Tax Rate.

From dxoyetnni.blob.core.windows.net

Barton County Missouri Property Tax at Helen Rosario blog Polk County Mo Property Tax Rate responsibilities as collector include mailing tax statements for personal property and real estate and their subsequent collection. Back to county information political subdivision. The county assessor’s responsibility is to place a value on all taxable real and personal property, within. missouri state auditor's office the office of missouri. under missouri law, property tax assessments must be based. Polk County Mo Property Tax Rate.

From taxfoundation.org

Monday Map Combined State and Local Sales Tax Rates Polk County Mo Property Tax Rate responsibilities as collector include mailing tax statements for personal property and real estate and their subsequent. the median property tax (also known as real estate tax) in polk county is $658.00 per year, based on a median home value of. The county assessor’s responsibility is to place a value on all taxable real and personal property, within. Back. Polk County Mo Property Tax Rate.

From exoxmsmgw.blob.core.windows.net

Jackson County Mo Property Tax Sale at Karen Ginsburg blog Polk County Mo Property Tax Rate Our polk county property tax calculator can estimate your property taxes based on similar. the median property tax (also known as real estate tax) in polk county is $658.00 per year, based on a median home value of. responsibilities as collector include mailing tax statements for personal property and real estate and their subsequent collection. Back to county. Polk County Mo Property Tax Rate.

From exoxmsmgw.blob.core.windows.net

Jackson County Mo Property Tax Sale at Karen Ginsburg blog Polk County Mo Property Tax Rate missouri state auditor's office the office of missouri. the median property tax (also known as real estate tax) in polk county is $658.00 per year, based on a median home value of. The county assessor’s responsibility is to place a value on all taxable real and personal property, within. responsibilities as collector include mailing tax statements for. Polk County Mo Property Tax Rate.

From www.countryhomesofamerica.com

59.1 acres in Polk County, Missouri Polk County Mo Property Tax Rate under missouri law, property tax assessments must be based upon market value and should be uniform. responsibilities as collector include mailing tax statements for personal property and real estate and their subsequent collection. The county assessor’s responsibility is to place a value on all taxable real and personal property, within. Our polk county property tax calculator can estimate. Polk County Mo Property Tax Rate.

From www.ctpost.com

Houstonarea property tax rates by county Polk County Mo Property Tax Rate responsibilities as collector include mailing tax statements for personal property and real estate and their subsequent. responsibilities as collector include mailing tax statements for personal property and real estate and their subsequent collection. the median property tax (also known as real estate tax) in polk county is $658.00 per year, based on a median home value of.. Polk County Mo Property Tax Rate.

From www.pdffiller.com

2022 Form MO MOPTC Chart Fill Online, Printable, Fillable, Blank Polk County Mo Property Tax Rate missouri state auditor's office the office of missouri. the median property tax (also known as real estate tax) in polk county is $658.00 per year, based on a median home value of. Our polk county property tax calculator can estimate your property taxes based on similar. responsibilities as collector include mailing tax statements for personal property and. Polk County Mo Property Tax Rate.

From showmeinstitute.org

Map of Commercial Property Tax Surcharges in Missouri Show Me Institute Polk County Mo Property Tax Rate under missouri law, property tax assessments must be based upon market value and should be uniform. Our polk county property tax calculator can estimate your property taxes based on similar. The county assessor’s responsibility is to place a value on all taxable real and personal property, within. the median property tax (also known as real estate tax) in. Polk County Mo Property Tax Rate.

From www.templateroller.com

Form MOPTC 2022 Fill Out, Sign Online and Download Printable PDF Polk County Mo Property Tax Rate Back to county information political subdivision. missouri state auditor's office the office of missouri. responsibilities as collector include mailing tax statements for personal property and real estate and their subsequent. Our polk county property tax calculator can estimate your property taxes based on similar. responsibilities as collector include mailing tax statements for personal property and real estate. Polk County Mo Property Tax Rate.

From propertyappraisers.us

Polk County Property Appraiser's Office, site, Map, Search Polk County Mo Property Tax Rate responsibilities as collector include mailing tax statements for personal property and real estate and their subsequent collection. Back to county information political subdivision. missouri state auditor's office the office of missouri. under missouri law, property tax assessments must be based upon market value and should be uniform. the median property tax (also known as real estate. Polk County Mo Property Tax Rate.

From dxoghktfj.blob.core.windows.net

Property Tax In Platte County Missouri at Anne William blog Polk County Mo Property Tax Rate responsibilities as collector include mailing tax statements for personal property and real estate and their subsequent. the median property tax (also known as real estate tax) in polk county is $658.00 per year, based on a median home value of. responsibilities as collector include mailing tax statements for personal property and real estate and their subsequent collection.. Polk County Mo Property Tax Rate.

From camilleoauria.pages.dev

Ca State Tax Brackets 2024 Bobbi Chrissy Polk County Mo Property Tax Rate under missouri law, property tax assessments must be based upon market value and should be uniform. the median property tax (also known as real estate tax) in polk county is $658.00 per year, based on a median home value of. The county assessor’s responsibility is to place a value on all taxable real and personal property, within. Our. Polk County Mo Property Tax Rate.

From www.polktaxes.com

Property Tax Bills Have Been Mailed Out Polk County Tax Collector Polk County Mo Property Tax Rate Our polk county property tax calculator can estimate your property taxes based on similar. responsibilities as collector include mailing tax statements for personal property and real estate and their subsequent. responsibilities as collector include mailing tax statements for personal property and real estate and their subsequent collection. Back to county information political subdivision. The county assessor’s responsibility is. Polk County Mo Property Tax Rate.

From fox4kc.com

Jackson County homeowners seek to pay taxes under protest FOX 4 Polk County Mo Property Tax Rate Back to county information political subdivision. The county assessor’s responsibility is to place a value on all taxable real and personal property, within. missouri state auditor's office the office of missouri. responsibilities as collector include mailing tax statements for personal property and real estate and their subsequent. the median property tax (also known as real estate tax). Polk County Mo Property Tax Rate.

From local.aarp.org

Missouri State Tax Guide What You’ll Pay in 2024 Polk County Mo Property Tax Rate under missouri law, property tax assessments must be based upon market value and should be uniform. The county assessor’s responsibility is to place a value on all taxable real and personal property, within. Back to county information political subdivision. the median property tax (also known as real estate tax) in polk county is $658.00 per year, based on. Polk County Mo Property Tax Rate.